I did a detailed budget plan to map out what we live on a year (not counting taxes) and we live on $32,620 in 2022! This amount includes all our expenses like mortgage/property-taxes/insurance, utilities, even our current car loan, subscriptions, food, gas, haircuts (for the males), medical/dental and even extras. The $32,620 does not include the federal income taxes, SS tax, medicare tax or Ohio state and local taxes and doesn't include anything that would come up like emergencies. It is just basic living without dire emergencies. We also don't receive any government handouts or food stamps or anything like that. We are just frugal in our daily expenses. I'm not sharing our income because my husband asked me not to, but I wanted to do a post to show people how it is possible to live a nice life under $40,000 still in America without the government. We use our extra income to save, spend on things we want and vacations and give away to those in need. We of course pay tithe and offering to our church.

Dave Ramsey teaches the 4-walls concept, of which I've blogged about before. Which prioritizes the important 4 things - food, shelter, transportation and clothing. You take care of those things first he recommends. I'm going to go over each of these and give you some tips on how we manage each one.

When it comes to shelter, or rather housing, we followed the principle of only buying or renting at 25% or less of our gross income and that has served us very well; especially now with enormous housing costs out there! We qualified for a larger amount of a mortgage but we instead took over half of that and purchased a nice, modest home. It was well under the 25% mark and was one of the best financial decisions we've ever made. Having the housing fixed, helps everything else just fall in place! I really believe housing cost is the single, most important factor (after God) when it comes to your budget. If you don't have the costs limited to 25% or less of our income, you will have to dramatically cut in other areas. I know many are saying it is impossible today but you have to live where you can afford and in what you can afford. If people would say NO, I'm not going to pay these high prices for rent or housing, then maybe the price would come down. Otherwise, you give in and you are house-broke and that's not place you want to be, trust me. If I had to live in an RV or a tiny house, then that is what I'd have to do until either prices went down or income went up. Don't get yourself into something you can't afford because although your mortgage may not go up if you got a fixed rate, your property taxes and homeowner's insurance most definitely will rise year after year.

Food is one place that I personally feel that most Americans really overdo it on. A family of 4 can easily eat a good, healthy diet on $360 a month, which is $90 a week for a 4-week month. It really depends on what your preferences are, what you consider luxuries or if you want to spend a lot of your money on food. Do you want steak everyday, or would you rather save up for a vacation? You would be surprised how much money will open up in your budget if you really bottom out on this now. Most American families of 4 spend double or triple the amount I listed, so there is room for improvement.

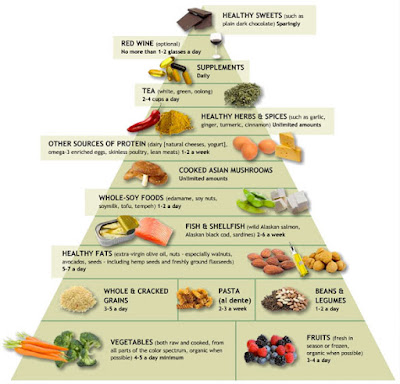

We follow the Mediterranean diet way of eating mostly - which I believe is the healthiest way of eating. Dr. Weil, my favorite doctor since I was 15, has a great food guide pyramid for his way of eating that is similar:

You can see how meats are not center stage, they are rather 2-4 times a week depending on what type of meat and red meat is sparingly. I think it's one of the best food pyramids out there and if you go to his website, you can read a detailed version of each category. If you follow this way of eating, you will almost have virtually no preventable disease, as it is anti-inflammatory. If you want to eat meat every day like the average American, then be ready to shell out big bucks to big Pharma and the doctors, hospitals, etc. America is the most drugged nation in the world and diet has a lot to do with it, if not everything. I don't know about you, but I hate medical bills and definitely don't want to be on a drug other than temporarily for a sickness!

Transportation is a must unless you live in a city and walk to everything or take an Uber or cab. You have to budget for a vehicle, gas, insurance, maintenance and repairs. I've found that if you keep up on the maintenance, you rarely have unexpected repairs. After living with only ever having one car at a time for over 22 years, we now own two cars for the first time. I felt something come over me early last winter to get a second car and it was so overwhelming that I bought a car within 24 hours of this feeling. It definitely was the Holy Spirit because not only did I get the car for $6000 (down from $9000), but it was even before the used cars went up and were in demand. Nobody even foresaw that was going to happen but God did. Now, that car is worth $14,000! I wanted to share that to show you that you must follow the leading of the Holy Spirit in everything. There are people that laugh at that because they don't know what a lot other Christians have learned - that God even cares about the small and everyday things. You have not because you ask not! Make sure you replace tires before they have chance of going out and always get your regular oil changes. When you replace the brake pads, replace the rotors too - yes, every single time. Keep up with maintenance for your particular vehicle and prevention is key to cutting out costly repairs later.

I don't necessarily feel today in our society that clothing is that needed as a monthly thing and maybe that's why we can live on so little comfortably. Don't get me wrong, I have clothes, but I don't buy clothes every month. I normally buy clothes once a year if that. I take good care of the clothes I already have and then I only have one growing child at the moment who changes clothing sizes twice a year, as my oldest is 18. I think the clothing thing is what trips up most families, especially women. I used to be one of those women that was so into my appearance that it drained our finances. God worked on me over the years and now, my husband has to literally force me to buy myself something. I do however make sure my kids always have nice clothes to wear but I've got it down to a science of when to buy and what based on our activities.

That's just a very brief summary of the 4-walls and how we do it. I may do a more detailed post in the future but you can also find older posts I've already done on these things: